Can the news foretell a property bust?

|

|

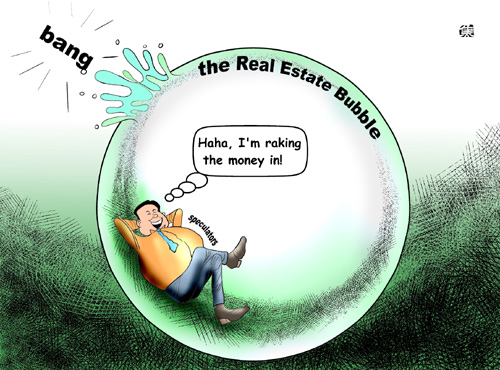

Sitting pretty? [By Jiao Haiyang/China.org.cn] |

Warren Buffett, considered one of the world's savviest investors, testified before a US Congressional commission about the housing crash that nearly caused the collapse of financial markets. "The whole American public was caught up in a belief that American housing couldn't fall dramatically," said Mr. Buffett. "Very, very few people could appreciate the bubble. That's the nature of bubbles – they're mass delusions." Beholding a lavish feast, even the wisest among us can forget the history of famines.

Mr. Buffett's comments raise the question of whether expert economists and investors, much less laypeople, can foresee busts. Yet a strikingly simple tool developed by The Economist magazine suggests a way to do so. Called the R-word index, the gauge measures instances of the word "recession" in the Washington Post and the New York Times. A sharp, fast rise in the quarterly count preceded the US recessions starting in 1981, 1990, 2001, and 2008. Adding to its credibility, the indicator fell each time when economic recovery began to take hold.

With the R-index in mind, I researched news stories mentioning a property bubble in China and found alarming statistics. On the website for China Daily, 62 stories published in 2009 make reference to one. Last year, that figure doubled. Google News, which automatically gathers links to articles worldwide, provides a broader look. For 2009, the site identifies 198 stories using the phrase "property bubble" in the context of China. For 2010, the tally climbs sixfold to 1,120. So far this year, the press is writing about China's frothy real estate market even more frequently. With over 400 references through mid-February, the total for 2011 may triple last year's.

Relying on a simplistic approach to predict the bursting of a market bubble may seem foolish. Yet no formulas exist for pinpointing the end of mass delusions about the value of certain assets. While the search continues, buyers and lenders should take note that surging debate about a Chinese property bubble may be a sign that it's ready to pop.

The author is a journalist, consultant, and former Director at CB Richard Ellis, a global real estate services firm. You may reach him at jkuperman@yahoo.com.

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn

0

0